click to enlarge

The NAR reported total sales were up 9.1% from January 2012, but conventional sales are probably up closer to 20% (or more) from January 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes - foreclosures and short sales - accounted for 23 percent of January sales, down from 24 percent in December and 35 percent in January 2012.Although this survey isn't perfect, if total sales were up 9.1% from January 2012, and distressed sales declined from 35% of total sales to 23%, this suggests conventional sales were up sharply year-over-year - a good sign.

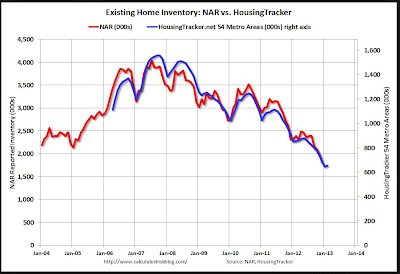

And what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory could come on the market and keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

Read more at http://www.calculatedriskblog.com/#2AAzzgLb33VA8c2t.99